News

The First Trust Managed Municipal ETF targets tax-advantaged income by investing primarily in municipal debt securities nationwide.

Via The Motley Fool · January 30, 2026

The ETF would need to continue on its current path for a couple of decades.

Via The Motley Fool · January 30, 2026

Bitcoin tapped $82,000 overnight, with liquidations at $1.80 billion over the past 24 hours. Bitcoin ETFs saw $817.9 million in net outflows on Thursday, while Ethereum ETFs reported $155.6 million in net outflows. The meme coin sector fell 9% over the past 24 hours to a total market capitalization of $40.6 billion amid the broader selloff.

Via Benzinga · January 30, 2026

Semiconductors have been one of the market's best-performing sectors. Thanks to these catalysts, the good times may not be over yet.

Via The Motley Fool · January 30, 2026

The SPDR Gold Shares ETF has crushed Bitcoin, Nvidia, and the entire S&P 500 this year.

Via The Motley Fool · January 30, 2026

Franklin Resources has outpaced the broader market over the past year, and Wall Street analysts remain cautious about the company’s near-term performance and long-term outlook.

Via Barchart.com · January 30, 2026

Retail sentiment on major ETFs such as SPY and QQQ remains ‘bearish’ on Stocktwits despite easing shutdown risks.

Via Stocktwits · January 30, 2026

Spending on AI infrastructure is expected to be measured in the trillions of dollars.

Via The Motley Fool · January 30, 2026

This is the second time El Salvador has bought gold since 1990, following an IMF-mandated acquisition of nearly 14,000 troy ounces in 2025.

Via Stocktwits · January 30, 2026

This asset management firm targets long-term growth by investing in U.S. companies with strong management and reinvestment potential.

Via The Motley Fool · January 29, 2026

The Invesco BulletShares 2030 Corporate Bond ETF offers targeted exposure to investment grade bonds with a defined maturity profile.

Via The Motley Fool · January 29, 2026

The First Trust Enhanced Short Maturity ETF targets short-term, high-quality debt securities for income and capital preservation.

Via The Motley Fool · January 29, 2026

Investors are piling into gold on the back of surging political and economic uncertainty.

Via The Motley Fool · January 29, 2026

This fintech firm delivers mobile-first, fee-free banking services targeting U.S. consumers seeking accessible financial solutions.

Via The Motley Fool · January 29, 2026

On January 29, 2026, the global financial landscape reached a fever pitch as spot gold surged to an unprecedented all-time high of $5,595 per ounce, while silver staged a "parabolic" ascent to touch $120.45 per ounce. This monumental rally, which analysts are calling the "Great Revaluation," marks a

Via MarketMinute · January 29, 2026

The global software sector experienced one of its most turbulent trading sessions in recent history on January 29, 2026, as a wave of "sympathetic" selling swept through the industry’s heavyweights. The catalyst for the downturn was a cooling sentiment toward the artificial intelligence boom, sparked by a fiscal second-quarter

Via MarketMinute · January 29, 2026

The global financial landscape reached a historic inflection point on January 29, 2026, as gold prices surged past the $5,500 per ounce mark, marking an unprecedented milestone in the history of precious metals. This "metal mania" reflects a profound shift in investor sentiment, as the traditional pillars of the

Via MarketMinute · January 29, 2026

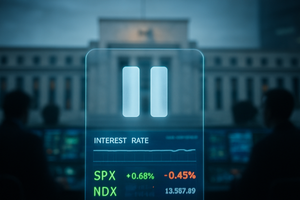

In a move that signaled a shift from aggressive easing to a strategic "wait-and-see" approach, the Federal Open Market Committee (FOMC) concluded its two-day policy meeting on January 28, 2026, by voting to maintain the federal funds rate at a target range of 3.50% to 3.75%. The decision

Via MarketMinute · January 29, 2026

These ETFs offer investors two different approaches for investing in the growing robotics boom.

Via The Motley Fool · January 29, 2026

An ETF CEO shares a look at what could help the ETF sector in 2026 and more details on a new ETF launch.

Via Benzinga · January 29, 2026

Gold ETFs GLD and IAU shattered volume records as spot gold whipsawed nearly 10% intraday, highlighting ETFs' role in price discovery.

Via Benzinga · January 29, 2026

Gold and silver miners including Newmont, Barrick Mining, First Majestic Silver and Pan American Silver close lower Thursday, potentially due to profit-taking.

Via Benzinga · January 29, 2026

The Bitwise Crypto Industry Innovators ETF is an interesting, potentially rewarding way to play the cryptocurrency space, but investors need to know what they're owning with this fund.

Via The Motley Fool · January 29, 2026

Clean energy ETFs slid sharply as Bloom Energy's volatile rally cooled, highlighting how single-stock momentum can distort thematic ETF returns.

Via Benzinga · January 29, 2026

Invesco BuyBack Achievers ETF tracks U.S. companies with robust share repurchase activity using a rules-based, diversified approach.

Via The Motley Fool · January 29, 2026