Latest News

Goldman Sachs gave the salad stock a thumbs-down.

Via The Motley Fool · January 30, 2026

These 10 stocks posted best or worst months ever in January. Earnings surprises, AI disruption and sector rotation explain why.

Via Benzinga · January 30, 2026

The financial services company's share price has plummeted in the past year. Is it cheap enough to buy?

Via The Motley Fool · January 30, 2026

Before you start socking away money for retirement, you'll need to pick an account type. But choose wisely -- because it'll shape your tax bill today and potentially decades from now.

Via The Motley Fool · January 30, 2026

Via Benzinga · January 30, 2026

Gold fell 9.5% and silver collapsed 27%, sparking a mining stock bloodbath as markets repriced Fed risk after Trump named Kevin Warsh as chair.

Via Benzinga · January 30, 2026

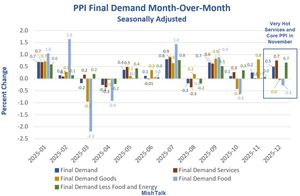

Yesterday, Jerome Powell prematurely praised a decline in services inflation.

Via Talk Markets · January 30, 2026

WisdomTree (WT) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

SoFi stock is sinking, even though the fintech firm reported a blockbuster Q4 on Friday. Here’s why the selloff is a buying opportunity for long-term investors.

Via Barchart.com · January 30, 2026

Via MarketBeat · January 30, 2026

Webull’s stock slid over 3% on Friday, to clock an all-time low of $6.96 in intra-day trading.

Via Stocktwits · January 30, 2026

Via Benzinga · January 30, 2026

Standex (SXI) Q2 2026 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

Standex (SXI) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

Standex (SXI) Q1 2026 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

Standex (SXI) Q3 2025 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

One increase was modest, while the other represented a double-digit percentage improvement.

Via The Motley Fool · January 30, 2026

Following a turbulent period of political gridlock and fiscal uncertainty, new data released by the U.S. Census Bureau on January 21, 2026, reveals that U.S. construction spending rose by 0.5% in October 2025. This increase brought the seasonally adjusted annual rate to $2.175 trillion, a figure

Via MarketMinute · January 30, 2026

The silver market in 2026 feels less like a traditional commodity rally and more like a meme stock frenzy, full of volatility.

Via Benzinga · January 30, 2026

Standex (SXI) Q1 2025 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

The Conference Board’s Leading Economic Index (LEI) recorded a 0.3% slip in its latest reading, signaling a cooling trajectory for the United States economy as it enters the new year. This downturn, reported in January 2026, marks a pivotal moment for markets that have been grappling with the

Via MarketMinute · January 30, 2026

The American consumer is beginning to see a light at the end of the inflationary tunnel. According to the final January 2026 reading from the University of Michigan Survey of Consumers, one-year inflation expectations have eased to 4.0%, down from 4.2% in December and a peak earlier in

Via MarketMinute · January 30, 2026

In a decisive move to reassure investors and capitalize on what it perceives as an undervalued stock price, Experian PLC (LSE: EXPN) announced a massive $1 billion share buyback program on January 30, 2026. The program, which commenced immediately upon announcement, is designed to reduce the company's ordinary share capital

Via MarketMinute · January 30, 2026

As of January 30, 2026, the global semiconductor landscape has reached a pivotal inflection point, with China officially declaring 2026 the "first year" of large-scale glass substrate production. This strategic move marks a decisive shift away from traditional organic resin substrates, which have dominated the industry for decades but are now struggling to support the [...]

Via TokenRing AI · January 30, 2026

Cavco (CVCO) Q2 2026 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

Sandisk stock soars on a blockbuster Q2 release, but a Cantor Fitzgerald analyst says SNDK shares aren’t out of juice just yet.

Via Barchart.com · January 30, 2026

Cavco (CVCO) Q1 2026 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

In a month characterized by high-stakes brinkmanship and a dramatic reshuffling of global energy maps, West Texas Intermediate (WTI) crude oil has found a precarious footing, stabilizing at the $65 per barrel threshold as of late January 2026. This stabilization comes after a volatile 15% rally throughout the month, a

Via MarketMinute · January 30, 2026

As the global demand for artificial intelligence continues to spiral, the industry has hit a formidable roadblock: the "energy wall." With massive Large Language Models (LLMs) consuming megawatts of power and pushing data center grids to their breaking point, the race for a more sustainable computing architecture has moved from the fringes of research to [...]

Via TokenRing AI · January 30, 2026

March NY world sugar #11 (SBH26 ) on Friday closed down -0.43 (-2.93%), and March London ICE white sugar #5 (SWH26 ) closed down -7.10 (-1.72%). This week's plunge in sugar prices continued on Friday, with NY sugar dropping to a 2.5-month low and Lon...

Via Barchart.com · January 30, 2026

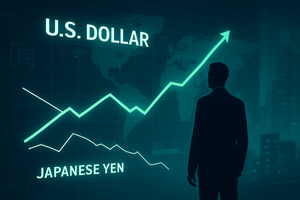

WASHINGTON D.C. — The global currency markets have been sent into a whirlwind this week as the U.S. Dollar staged a powerful recovery against the Japanese Yen. The surge followed definitive comments from U.S. Treasury Secretary Scott Bessent, who effectively shut the door on rumors of a coordinated

Via MarketMinute · January 30, 2026

You would have made a nice return.

Via The Motley Fool · January 30, 2026

March ICE NY cocoa (CCH26 ) on Friday closed down -12 (-0.29%), and March ICE London cocoa #7 (CAH26 ) closed down -1 (-0.03%). Cocoa prices extended their month-long slide on Friday, with NY cocoa posting a 2.25-year nearest-futures low and London...

Via Barchart.com · January 30, 2026

As of January 30, 2026, the United States' ambitious effort to repatriate semiconductor manufacturing has officially transitioned from a period of legislative hype and groundbreaking ceremonies to a reality of high-volume manufacturing (HVM). With over $30 billion in federal awards from the CHIPS and Science Act now flowing into the ecosystem, the "Silicon Desert" of [...]

Via TokenRing AI · January 30, 2026

Tighter Medicare Advantage payment rates are testing two established health insurers, with CVS Health offering a safer dividend entry at 28% upside and 3% yield while Humana's 36% year-over-year decline creates a riskier but potentially stronger boun...

Via Barchart.com · January 30, 2026

March arabica coffee (KCH26 ) on Friday closed down -13.25 (-3.845%), and March ICE robusta coffee (RMH26 ) closed down -66 (-1.58%). Coffee prices retreated on Friday, with arabica posting a 5.5-month nearest-futures low and robusta sliding to a 3.5...

Via Barchart.com · January 30, 2026

The U.S. bond market is witnessing a significant recalibration as the 10-Year Treasury yield climbed to a pivotal 4.24% today, January 30, 2026. This surge, fueled by a combination of persistent "low-grade fever" inflation and heightened geopolitical friction, was further solidified by President Donald Trump’s official nomination

Via MarketMinute · January 30, 2026

As of January 2026, the artificial intelligence landscape has transitioned from a period of desperate hardware scarcity to an era of fierce architectural competition. While NVIDIA Corporation (NASDAQ: NVDA) maintained a near-monopoly on high-end AI training for years, the narrative has shifted in the enterprise data center. The arrival of the Advanced Micro Devices, Inc. [...]

Via TokenRing AI · January 30, 2026

Cavco (CVCO) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

Joby Aviation has been burning cash in the past few years as it worked on its aircraft, which it expects to enter service later this year or early next year.

Via Talk Markets · January 30, 2026

Via Benzinga · January 30, 2026

The final week of January 2026 has been defined by a return to "tariff diplomacy" and a surreal geopolitical standoff over the world’s largest island, sending ripples of volatility through the S&P 500. President Trump’s dual-track strategy of threatening 100% tariffs on Canadian goods while simultaneously pressuring

Via MarketMinute · January 30, 2026

The rapid evolution of artificial intelligence has reached a critical juncture where the physical limitations of electricity are no longer sufficient to power the next generation of intelligence. For years, the industry has warned of the "Memory Wall"—the bottleneck where data cannot move between processors and memory fast enough to keep up with computation. As [...]

Via TokenRing AI · January 30, 2026

Cavco (CVCO) Q2 2025 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

Baseten is carving out a high-growth niche in the AI market.

Via The Motley Fool · January 30, 2026

The U.S. housing market faced a chilling end to 2025 as the National Association of Realtors (NAR) reported a staggering 9.3% plunge in pending home sales for December. This sharp month-over-month decline pushed contract signings to their lowest level since the onset of the COVID-19 pandemic in 2020,

Via MarketMinute · January 30, 2026

As of early 2026, the semiconductor industry has reached a definitive turning point where the traditional method of scaling—simply making transistors smaller—is no longer the primary driver of computing power. Instead, the focus has shifted to "Advanced Packaging," a sophisticated method of stacking and connecting multiple chips to act as a single, massive processor. At [...]

Via TokenRing AI · January 30, 2026

The United States labor market once again demonstrated its remarkable durability as initial jobless claims for the week ending January 24, 2026, fell to a seasonally adjusted 200,000. This figure arrived significantly lower than the consensus forecast of 206,000, signaling that despite high interest rates and a cooling

Via MarketMinute · January 30, 2026

As of late January 2026, the global semiconductor industry has entered a volatile new chapter. Following years of tightening export controls, a complex "revenue-for-access" truce has emerged between Washington and Beijing, fundamentally altering the strategic calculus for NVIDIA Corporation (NASDAQ: NVDA). While recent regulatory shifts have nominally reopened the door for NVIDIA’s high-performance H200 chips, [...]

Via TokenRing AI · January 30, 2026

The global precious metals market suffered its most violent "flash crash" in recent history today, January 30, 2026, as a "perfect storm" of hawkish U.S. monetary policy signals and massive technical liquidations erased months of gains in a matter of hours. Gold prices, which had reached a staggering peak

Via MarketMinute · January 30, 2026