General Motors (GM)

84.24

+0.94 (1.13%)

NYSE · Last Trade: Feb 7th, 5:40 PM EST

Volkswagen has potentially found a way to roll out EVs while mitigating their short-term problems.

Via The Motley Fool · February 7, 2026

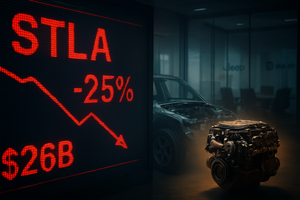

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

Investors were surprised by the cost of Stellantis's EV reset, and not in a good way.

Via The Motley Fool · February 6, 2026

BYD is the top dog in the Chinese auto market, but the world's largest EV market is set for a shock in 2026. Can BYD survive and thrive without help from Beijing?

Via The Motley Fool · February 6, 2026

In a staggering reversal that has stunned global commodity markets, gold prices have retreated sharply from their historic record highs, recording a massive 11% correction over the past week. The sell-off, which culminated in a violent "flash crash" on January 30, 2026, saw spot gold tumble from a peak of

Via MarketMinute · February 6, 2026

GM's financial performance in 2025 cut through a lot of industry noise, and what investors need to hear is clear.

Via The Motley Fool · February 6, 2026

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

Date: February 6, 2026 Introduction As of early 2026, Tesla (Nasdaq: TSLA) finds itself at the most critical juncture since the 2018 "Model 3 production hell." No longer just a high-growth electric vehicle manufacturer, Tesla is aggressively rebranding itself as a "Physical AI" and robotics powerhouse. This transition comes at a time when its core [...]

Via Finterra · February 6, 2026

Ford is America's oldest automaker, and it's set to potentially become its largest over the next five years.

Via The Motley Fool · February 6, 2026

This stock has been largely overlooked by investors, but the business is performing exceptionally well.

Via The Motley Fool · February 6, 2026

The global economic landscape has been jolted in the opening weeks of 2026 as the United States government formalizes a series of aggressive 25% tariff proposals targeting the critical sectors of semiconductors, automobiles, and pharmaceuticals. These measures, framed as essential for national security and domestic industrial revitalization, have sent shockwaves

Via MarketMinute · February 5, 2026

As the calendar turns to early February 2026, the global financial community is fixated on 1 First Street NE, Washington, D.C. The Supreme Court of the United States is expected to issue a final ruling in Learning Resources, Inc. v. Trump, a consolidated case that challenges the legality of

Via MarketMinute · February 5, 2026

If you're only considering dividends when comparing value returned to shareholders, you'll miss hidden gems such as General Motors.

Via The Motley Fool · February 5, 2026

The long-standing "copper supercycle" narrative faced a stark reality check this week as benchmark prices for the red metal plummeted below the critical psychological threshold of $13,000 per metric ton. On the London Metal Exchange (LME), three-month copper futures tumbled to a low of $12,650, marking a significant

Via MarketMinute · February 5, 2026

Via MarketBeat · February 5, 2026

Rivian is an innovative EV company making some neat trucks and SUVs, but is it a buy at these prices?

Via The Motley Fool · February 5, 2026

Canadian PM considering scrapping EV mandate for revised fuel standards and EV Credits, mulls EV rebate comeback.

Via Benzinga · February 5, 2026

Coffee, cars, silver, and more.

Via The Motley Fool · February 4, 2026

Lear (LEA) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 4, 2026

As Citizens Financial Group has outpaced the broader market over the past year, Wall Street analysts remain bullish about the stock’s prospects.

Via Barchart.com · February 4, 2026

A richer dividend and cheap valuation put GM back on income investors’ radar despite restructuring noise.

Via Barchart.com · February 3, 2026

Via Benzinga · February 3, 2026

Trump’s $12 billion Project Vault rare‑earths reserve gives General Motors, Stellantis, and Boeing a policy‑backed edge on critical minerals.

Via Barchart.com · February 3, 2026

The automaker has soared in the past year, but could there be more room to the upside?

Via The Motley Fool · February 3, 2026